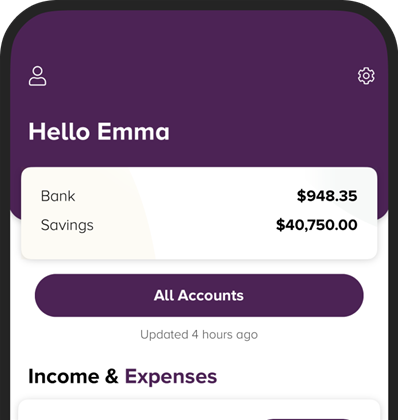

Beyond Bank has begun piloting ‘Beyond Bank+’, a new money mangement app that gives customers a complete view of their money across over 400 financial institutions.

The customer-owned bank uses Frollo’s personal finance management (PFM) platform and open banking platform, CDR Gateway, to add ‘financial well-being’ features to the app.

The badged version of Frollo's white-label app customised for Beyond Bank’s 290,000 customers will also act as a companion service alongside the bank's current digital app.

Beyond Bank became an accredited data recipient last September under the government's consumer data right scheme, allowing the bank to receive consumer data and offer open banking products and services.

A spokesperson from Beyond Bank said the Beyond Bank+ app was initially trialled with “a controlled pilot group using ’screen scraping’ to collate transactions” in September.

“We went down this path as it allowed us to get moving faster, testing both the entire customer experience and our internal processes before launching more broadly,” the spokesperson said.

The spokesperson said the early launch “worked very well”, but “when we did launch to customers it was using open banking instead of screen scraping to provide the best possible experience.”

“With any new technology, you expect minor delays but it’s all about providing our customers with the best possible experience and we’re delighted to date with the results,” the spokesperson added.

Beyond Bank general manager customer experience Nick May said “it’s important that banks do as much of the heavy lifting as they can to help individuals and families keep a close watch on household budgets” as the cost of living continues to rise.

“This app allows our customers to understand their money better and, in turn, make smart decisions about their financial future,” said May.

Frollo's PFM platform is also used by comparison site Canstar and Virgin Money for their money management and banking apps.

The fintech also supported neobank Volt, which announced its closure last week.