People’s Choice Credit Union is two years into a digital transformation that sees it re-platforming on the cloud and adopting agile ways of work in pursuit of a more “member-centric target operating model”.

The credit union - headquartered in Adelaide with a presence in five states and territories and over 375,000 members - had its transformation strategy “endorsed through the levels of our organisation in the first half of 2018,” head of digital and transformation Sean Cummins told a recent Salesforce event.

“We commenced initiation of some of the core foundational elements … in the second half of that calendar year,” Cummins said.

“In 2019, we focused on initiation and really starting to work across our partners that we would require based on our desired architecture and our member-centric target operating model that were important for us to truly transform.

“For People's Choice, we see ourselves more as an orchestrator of key partners that can help us to deliver, both at a program level and ongoing, and so that was a very key foundational element of what we needed to achieve.

“[In] the second half of 2019, [we] focused on setting ourselves up for success from a delivery perspective.”

Part of setting itself up for success was shifting internal ways of working to an agile structure.

The credit union wanted to “break down silos” and “create very clear lines of ownership and accountability” to keep internal teams focused on the end goals of the transformation: creating member-centric and ultimately omnichannel experiences.

“Our transformation strategy was about our ... desire to form a member-centric target operating model, and as part of that we have a very strong focus on omnichannel,” Cummins said.

“With omnichannel, we've really taken a good look at ourselves and really started to understand what is it that we do today.

“Certainly, we could have been optimistic about self-assessment and said that we do do some components of omnichannel, but in reality we were much more of a multi-channel organisation.

“That is, we provided some really effective services and products to our membership and to our community, but there was low levels of integration across the board.”

Integration is both a cultural and technical problem.

While the cultural element is largely being addressed with agile, the technical aspects of integration are still being put together.

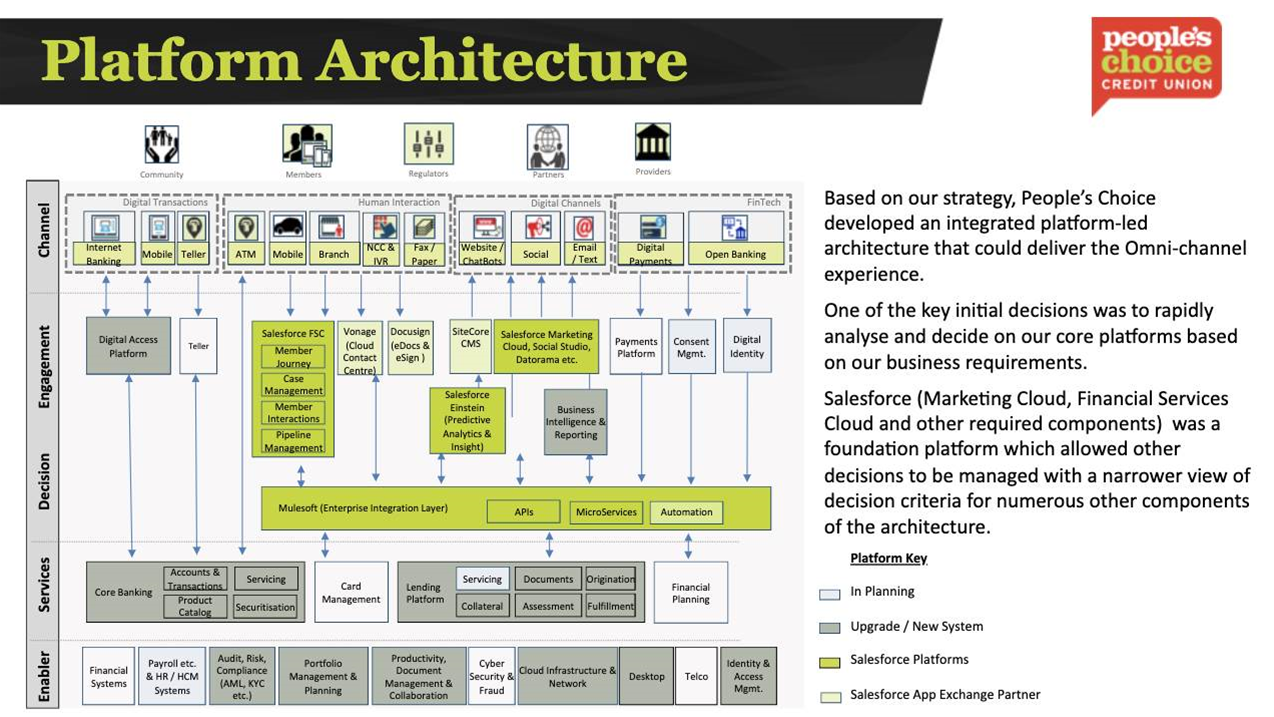

“With our platform architecture we did look to start to effectively build the foundations of our architecture, looking at platforms, how they enabled omnichannel, how they enabled member experience or our desired experience, and how we could keep pace with what the market is doing,” Cummins said.

One of its recently-adopted platforms is Salesforce, with the credit union consuming the vendor's financial services cloud, marketing cloud, Einstein AI and MuleSoft enterprise service bus platforms.

However, there is a large amount of re-platforming work ahead, as evidenced by an architectural diagram of the work.

“This is just to give you a view of some of the scale of the change that People's Choice is undertaking,” Cummins said.

“The boxes in a grey colour are where we're upgrading or we're going to new systems. The green boxes are where with Salesforce one of our core platforms that we've put in place.”

Cummins noted that People’s Choice is factoring out-of-the-box integrations that different technology platforms come with into its architectural decisions.

Open banking PoC

Cummins said that People’s Choice is currently “in the process of creating some proof of concepts for open banking.”

“Certainly we know we've got to be compliant, but where you take open banking from an experience perspective is something where we're looking at,” he said.

“The starting point is a design principle. We want to ensure that all the new technologies we build are built to scale for an open banking world.”

Cummins said that Salesforce, MuleSoft and Cuscal would all contribute to People’s Choice’s open banking implementation.

“We've encouraged all of our providers to come in and discuss openly with us what the opportunities are,” he said.

“We feel that [with] a lot of decisions we've made around the architecture that we should have hopefully what we need from a component perspective, but we're really asking for best practice from our partners.

“We're in the process of that right now and we're looking for - ideally, by the end of March - to really work through that, and develop a very clear plan for the way forward.”