A decision to block a network and spectrum sharing deal between Telstra and TPG Telecom relies heavily on evidence not in the public domain.

Full reasons published by the ACCC after blocking the proposed Telstra-TPG Telecom tie-up last week are so heavily redacted in key sections that it’s not clear what swayed the regulator in its decision-making.

There are 815 redactions across the 216 pages of the full determination. [pdf]

The end result is that it may never really be possible for most people to know what approval or rejection of the proposed deal hinges on.

What is clear is that the ACCC believes TPG Telecom can do better than aligning itself with Telstra.

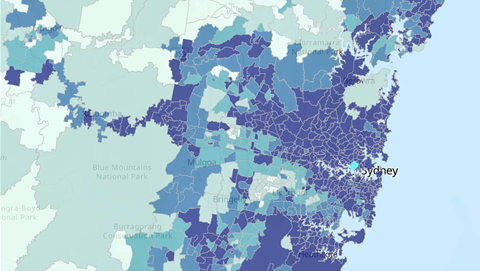

Favoured options in this context - at least from the ACCC’s perspective - are for TPG Telecom to run its own “targeted” build works on urban fringes and in regional Australia; or alternatively, to strike a roaming or network sharing deal with Optus.

The ACCC said it could not guess at what an Optus-TPG Telecom agreement might look like, but was convinced both had “strong commercial incentives to enter into a network sharing or roaming agreement” with the other.

“Any arrangement between Optus and TPG is likely to initially be for 4G roaming, and could potentially transition to 5G roaming before culminating in an active sharing arrangement,” the ACCC said.

“TPG and Optus may not be able to commence active sharing immediately. They could negotiate and agree on an active sharing agreement in the very short term, and it would be in their interests to do so to ensure alignment of spectrum and radio access network technology for a 5G roll-out.

“However, it is more likely they will be able to commence active sharing between 2025 and 2028.”

The reasoning around commercial incentives for both TPG Telecom and Optus is fully removed from the determination.

This results in around 10 pages of the determination showing little more than “[Redacted – Confidential]” on every line.

Optus’ evidence ‘sufficiently credible’

It’s a similar story in the section about how Optus and its parent Singtel say they would respond to a Telstra-TPG deal being approved.

The ACCC notes that this evidence was collected from “internal documents and sworn evidence”, which it said was “sufficiently credible for the ACCC to attach weight to.”

The commission saw a “real chance that Optus will not continue with its previously agreed 5G regional investment plan” if the Telstra-TPG deal proceeds.

It did not believe Optus would cease all infrastructure investments, but said the telco could have trouble securing funds from parent Singtel to bankroll an expansion.

“The ACCC does not consider it unreasonable to expect Singtel would be cautious about supporting investments where the net present value of an associated business case is only mildly positive,” it said.

Exit terms

The ACCC also said it had reservations about loose arrangements in the Telstra-TPG proposal for what would happen if TPG decided to exit.

TPG can exit after 10, 15 or 20 years, according to the ACCC, “with a transition-out period of up to 36 months”.

“However, there is a lack of clear obligations and rights when the parties begin to transition out which may ultimately mean that TPG will be at the behest of Telstra during exit negotiations,” the ACCC said.

“In a submission to the ACCC, Telstra determines the lack of specificity around the exit procedures to account for ‘the fact that it is unknown at this present time what would be the most efficient transition mechanism’ and allow the parties ‘flexibility’.”

“While this may be true,” the ACCC said, it could also mean “a difficult path to operating competitively post expiry or termination of the proposed transaction” for TPG, and the ACCC wasn’t keen on this approach.