TPG Telecom has set in motion a plan that would release it from rules that curtailed its fixed-line infrastructure ambitions and "likely" make it a “more robust competitor to NBN Co”.

The significant development would result if a fresh functional separation bid that the telco has filed with the Australian Competition and Consumer Commission (ACCC) is approved.

The ACCC is proposing to make a final call on the proposal in “early February 2022”, creating the potential for a major change in Australia’s broadband infrastructure market.

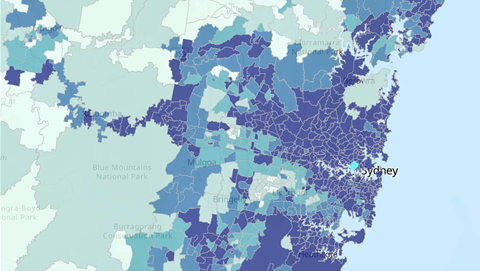

TPG had at one stage hoped to extend existing fibre assets to create a fibre-to-the-basement (FTTB) network servicing half a million premises in major capital cities.

However, as TPG’s service would have been live prior to the NBN, due to NBN Co building in the regions first and leaving cities until last, the government intervened and laid down rules that forced TPG to scale back its plans.

TPG has since tried - unsuccessfully - to end what it last year referred to as “NBN protectionism”, particularly on the basis the NBN is now finished and well-established.

If TPG can get the ACCC to sign off on a new functional separation undertaking or FSU, it would void some of the most intense restrictions the telco is currently under, according to the ACCC.

“If the ACCC accepts TPG’s undertaking, TPG would have greater flexibility to expand its network footprint and compete in wholesale and retail markets for the supply of superfast broadband services to residential customers,” the ACCC said in a consultation paper. [pdf]

“Importantly, the undertaking would also apply to any new superfast fixed-line broadband network infrastructure that TPG deploys.

“In the absence of the undertaking, we expect TPG to be restricted from expanding its network and competing for infrastructure builds.”

The ACCC offered a preliminary view that TPG Telecom’s proposal appeared to be in the long-term interest of internet end users, conditional on the telco meeting all its non-discrimination obligations.

To functionally separate on a groupwide basis, TPG Telecom said [pdf] it would set up FTTB Wholesale as the “wholesale entity for the … Group”.

Pipe Networks and TransACT would offer their network infrastructure only to FTTB Wholesale.

FTTB Wholesale “will in turn supply TPG retailers as well as third party wholesalers with local access line services and other ancillary wholesale services.”

To make the structure cost-effective, all parts of TPG would make use of shared corporate services and network engineering services, under TPG’s proposal.

The ACCC indicated the structure, if signed off, would make TPG a stronger competitor to NBN Co.

“The ACCC considers that accepting TPG’s undertaking is likely to promote infrastructure-based competition as it will enable TPG to extend its network footprint and compete for infrastructure builds in new developments,” the commission said in its paper.

“Consolidating TPG’s networks under the undertaking is likely to make TPG a more robust competitor to NBN Co where its networks have been overbuilt.”

The ACCC has set a December 17 deadline for industry feedback on TPG Telecom’s proposal, which is available in full here. [pdf]

The move is unlikely to be popular with NBN Co, which has previously argued against unwinding rules that keep TPG Telecom at bay as an infrastructure competitor.

TPG is also now much larger and better-resourced than it was when it first tried to roll out an FTTB network, courtesy of a $15 billion merger with Vodafone Australia completed in 2020.

NBN Co has generally argued that its protections should be increased rather than reduced, owing to an increase in the number of challengers to its monopoly status.