Growth in mobile and fixed wireless services has consolidated TPG Telecom’s return to growth, but CEO Iñaki Berroeta identified NBN costs and rising handset prices as significant headwinds in announcing the company’s second half 2022 results.

The company added 135,000 mobile services in the half year, and returned to “modest” average revenue per user (ARPU) growth to $31.80, Berroeta said.

Postpaid ARPU was much higher, at $42, which Berroeta attributed to the return of international travel 70 percent of pre-Covid levels in June, driving an increase in international roaming.

Prepaid subscriber numbers also rose by 120,000 as international travellers returned.

“For our fixed wireless business, we reported a 33,000 increase in subscribers to 130,000,” Berroeta said, “and we remain confident of achieving our 160,000 subscriber target in December as we tackle supply chain constraints pertaining to modem availability and chipset shortages.”

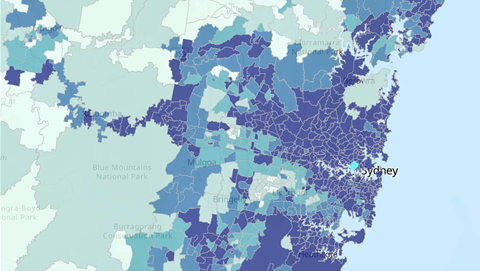

The company has 150,000 on-net customers using its fixed network services, which encompasses owned fixed-line and fixed wireless infrastructure.

Total revenue rose by just 0.7 percent in the half year, to $2.19 billion.

“Importantly, our on-net products are delivering a margin benefit over NBN products consistent with our expectations, which along with our pricing actions will support improved fixed margins over time,” he said.

“In fixed, our focus is on improving profitability through fixed wireless growth and NBN margin management,” he said.

That includes price rises: “We began communicating this week some modest increases to the prices of our lower speed NBN plans across parts of our customer base.”

He said the increases were necessary, “because the amounts we pay to NBN for use of its network have increased significantly, as a consequence of Australians relying more on their home broadband when they work and study from home.”

That’s created “margin pressures” for retail service providers, Berroeta said.

In an analyst call, Berroeta said the price increases would apply to about half of the company's broadband customer base.

TPG’s proposed network sharing arrangement with Telstra continues to await Australian Competition and Consumer Commission approval.

The ACCC's decision had been due in October, but today the ACCC updated its inquiry web page to say "November/December". TPG said it expects the decision to be published on December 2.

In the meantime, preparations continued, with Telstra and TPG now conducting service verification and testing.

In wholesale, TPG’s functional separation is due to become effective on 2 October.

“This undertaking will apply to all local access lines we control to the extent they are used to supply superfast carriage services wholly or principally to residential customers.

“This includes our existing FTTB [fibre-to-the-basement] networks in metro locations, the TransACT VDSL network in the ACT, our HFC networks in Ballarat, Mildura and Geelong, as well as any new superfast local access lines we deploy.”

All services will be offered to retailers under a single structure, he said, “under a simpler pricing structure than NBN”.

In future, the wholesale business segment, worth around $110 million annually, will be reported under TPG’s Enterprise, Government and Wholesale segment rather than in the consumer segment.

The company reported earnings before interest, taxes, depreciation, and amortisation (EBITDA) of $837 million (including $35 million of non-recurring restructuring costs).

The company also flagged a future IT transformation project to consolidate systems inherited from its various acquisitions in recent years. That would begin after TPG simplifies its organisational structure and its products.