TPG Telecom has signed an initial 10-year network sharing deal with Telstra, extendable by a further decade, that could come into effect by the end of 2022 subject to regulatory approvals.

The multi-operator core network (MOCN) agreement will give TPG access to around 3700 Telstra cellular towers in regional Australia and on urban fringes.

TPG Telecom will decommission 725 mobile sites it currently operates in the zone covered by the Telstra agreement.

It will also grant Telstra access to its 4G and 5G spectrum holdings, which will enable the incumbent to expand the coverage of its network.

“Telstra will share its radio access network (RAN) for 4G and subsequently 5G services in the defined coverage zone, however both carriers will continue to operate their own core network where key differentiating functionality resides,” the telcos said in a statement.

“Telstra will also obtain access to and deploy infrastructure on up to 169 TPG Telecom existing mobile sites, improving coverage for TPG and Telstra customers in the zone.

“The non-exclusive agreement includes the option for TPG Telecom to request two contract extensions of five years each.”

Exercise of the extensions is at TPG's discretion but would be based on accepting the same terms and conditions of the main decade-long agreement.

TPG Telecom CEO Iñaki Berroeta said the “landmark” network sharing agreement “represents a material uplift in the capability of our network and will provide significant value for TPG Telecom shareholders over the medium and long term.”

“We will be open for business in regional and rural Australia like never before,” he said.

“The agreement demonstrates best-practice asset utilisation and a commitment to rationalising our operations to deliver a better customer experience, while increasing capital efficiency.”

Telstra CEO Andrew Penn said the deal would “realise more value from Telstra’s network infrastructure for shareholders while making a very significant contribution to Telstra’s wholesale mobile revenues.”

Penn said the agreement would deliver between $1.6 billion and $1.8 billion in revenues over the first 10 years.

“The access is similar to the way Telstra currently provides wholesale services to its MVNOs [mobile virtual network operators] and [to low-cost sub-brand] Belong in this zone,” Penn said.

“It allows Telstra to have an innovative way of monetising some of our active mobile infrastructure, in areas where the population coverage is much smaller and more challenging in terms of returns and further investment and where there are already a number of competitors.

“Additional scale from this agreement therefore supports return on invested capital in these areas and makes ongoing investment in the network and innovation more sustainable.”

All of TPG’s brands that offer mobile services - including Vodafone, TPG, iiNet, Lebara and felix - will benefit from access to the portion of Telstra’s network.

The deal needs regulatory approval from the Australian Competition and Consumer Commission (ACCC) to proceed.

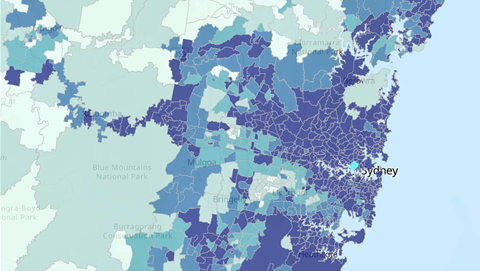

Coverage zone

Penn said that Telstra and TPG would continue to maintain their own separate networks to serve “core metro and inner regional populations”, equivalent to around 80 percent of Australia’s population.

The MOCN deal covers the zone just outside of this one, where coverage goes from 80 percent population coverage “to just over 98 percent population coverage.”

Penn said there is considerable competition in this zone already, meaning that TPG is unlikely to substantially shift the existing market dynamics by extending its reach in the area on the back of Telstra infrastructure.

Beyond the 98 percent, Telstra will continue to exclusively serve this area, maintaining its differentiation.

“The third zone is where the last percent of the population live and it covers an additional 1 million square kilometres of land mass,” Penn said.

“This is where Telstra will continue to maintain its network in differentiation in this zone.

“We’ll continue to be the only operator to provide services in this particular area.”

Penn said that under the MOCN agreement, both Telstra and TPG would "maintain their own [network] cores" - where you register services and where a lot of the differentiating functionality, things like network slicing and quality of service resides."

They would be "sharing radios in the defined zone" under the agreement.

Spectrum sharing

Telstra forecast short-term service improvements and easing of Covid-related congestion once it has access to shared spectrum under the MOCN arrangement.

It also said the additional spectrum would help it to expand the availability of fixed wireless services, as well as deliver longer-term capex savings in the region of hundreds of millions of dollars.

“Over the last three years we have seen major spectrum auctions that determine the holdings of important 5G spectrum holdings in low-band, mid-band and high-band,” Penn said.

“The important thing to remember with spectrum is those licenses - once those auctions are determined - are set for a long period of time, at least the next decade, and it is only through arrangements like this [MOCN] that we can further enhance our spectrum position which is available for our customers in this critical technology.

“The spectrum element of [MOCN] is very significant for Telstra. In particular. the spectrum agreement will ensure that regional and rural customers will now experience faster speeds in more locations on their mobiles, and it will give us the potential to offer more fixed wireless services across regional and rural Australia.”

Penn said that access to TPG’s 3.6GHz spectrum, in particular, would close the gap that rival Optus had with spectrum holdings in this mid-band.

However, he also added that Telstra could still live without the spectrum, if for whatever reason the deal was rejected by regulators.

“Our current [spectral] position is fine and we can make that work through a range of investments and aggregation in different technologies, but there’s no doubt the additional spectrum is useful in terms of enhancing experience and more immediate improvements, partticulrly around areas of congestion, and some capex efficiency over the longer term,” he said.

“More spectrum is always better than less.”

While cautioning he did not want to speak for them, Penn said he did not foresee issues with gaining regulatory approval of the MOCN agreement.

“I would like to think the ACCC see this as net positive for the industry and therefore would hope they’re supportive,” Penn said.

“We have to go through that process, and they’ll do their own reviews so we’ll have to be guided by that. But we dont foresee any particular air of concern, put it that way.”