Customer service is always important, but in today’s remote-working world, having more-and-better options to manage service requests, complaints and disputes is no longer ‘nice to have’ but a necessity to prevent reputational damage, potential regulatory exposure and loss of business. Essentially, the ability to manage complaints and disputes in an effective and compliant manner is now critical to success.

To explore how Australian organisations could improve their complaint and disputes management processes, iTNews recently hosted a webinar where Matthew Talbot (Head of Financial Services, APJ, ServiceNow) and Rahul Zarabi (Director, Financial Services Technology Consulting, EY) discussed the issue and also surveyed business leaders about the their management of it. The results were eye-opening…

Customer expectations have evolved quickly

Both the webinar and the survey showed that, since the start of the pandemic, there has been a sharp rise in the customer usage of digital channels to interact with organisations. This change, in Zarabi’s view, has led to a decline in trust in general as customers feel more disconnected. He says, “There are different views on what normal is and what customer priorities there are. Today's customer is more educated and has more ways to complain.”

Meanwhile, EY has been tracking an overall increase in customer complaints and disputes and, during the height of COVID, it was, “Astronomically high.”

There are also increased expectations when it comes to getting a resolution. Products are assessed on a more-critical scale than they used to be. According to EY research, a 12 per cent use of digital channels (pre-COVID-19 and in 2021) has now ballooned to 45 per cent. Furthermore, unhappy customers now inform twice as many people about negative experiences compared to pre-COVID.

Talbot says that the ‘new consumer’ now expects a modern, Facebook/Amazon/Google-like customer experience from traditional service providers, like banks. He adds, “Complaint and dispute handling must be a consistent experience with customers needing to know where they are in the process and when it is going to be resolved. From the customer’s perspective, every little problem is a major problem.”

What is done well and what needs to improve

The presenters agreed the biggest capability gap regarding customer complaint and dispute handling is that practice needs to reflect policy. While the majority of financial services organisations have policies based upon the RG 165/RG 271 regulations (which define what financial services firms must do to comply with ASIC requirements regarding complaints and dispute resolution), the reality is that they are not compliant in many areas. Zarabi makes the following observations:

- Complaints and Disputes handling systems: A common approach is to go straight to the CRM. Organisations that do it well are bridging the gap between the CRM and regulatory requirements and have a dispute resolution process in place.

- Complaints and Disputes operating model: Before COVID struck, this relationship was almost linear. But, there is now an emerging trend where organisations are moving towards a hybrid model where they uplift first-line support staff to handle the majority of complaints and disputes before a second level looks at specialist complaints or disputes.

- Vulnerable customer management: This is still not regulated, but there will be higher expectations in future as organisations want to know what complaints vulnerable customers are making and why.

Talbot added that the resources gap, training and problems surrounding COVID in general, accelerated complaint and disputes handling problems. For example, when COVID struck New Zealand's Kiwibank, was forced to temporarily close its branches but this saw its call centres get slammed. Talbot said, “So very quickly the Bank had to start automating its processes for how it serviced customers –everything from complaint and dispute handling to reporting.”

Develop an end-to-end complaints and disputes handling culture

How do organisations bridge the gaps between their CRMs, case management systems and compliance systems? Talbot believes complaints and disputes handling needs to be part of the business’ end-to-end processes - not isolated in separate systems as they have been in the past. Talbot says, “We are seeing opportunities to automate risk control in complaints and disputes case management processes and have this integrated with the CRM real time.”

Organisations can also improve by embedding an effective complaints and disputes handling culture across the business. Zarabi comments, “For a very long time, organisations have not valued complaints or disputes as an important information source and have not invested sufficient resources to handle this data.”

Without complaints and dispute information, organisations cannot act on them and the root cause of the problem is not dealt with. To improve the situation, it’s important to make it clear that someone is accountable for the complaints and disputes framework plus, has an effective delegation of responsibilities to other team members in an end-to-end, complaints-handling framework.

“We need to remind staff that we value complaints and disputes and what they tell us about our products, services and our people,” Zarabi said. “It allows us to fix the underlying issue. That is a fundamental benefit.”

The presenters agreed financial services firms should bring processes and people together and then use the technology to support it, not the other way around. The consensus was that, while it is important to better-manage complaints and disputes, it is also important to reduce the number of complaints and disputes that an organisation is receiving in the first place.

Counting the benefits of better complaint and dispute handling

Both the discussion and survey showed that better complaint and dispute handling will deliver tangible business benefits with Talbot saying that it also helps employees and reduces costs by driving efficiencies. “Many organisations have siloed solutions and manage these separately, which is hard. But, from a consumer point of view, they don't care. Addressing the omnichannel approach has become very important for financial services companies as you can't get a consistent user experience if you are running siloed systems.”

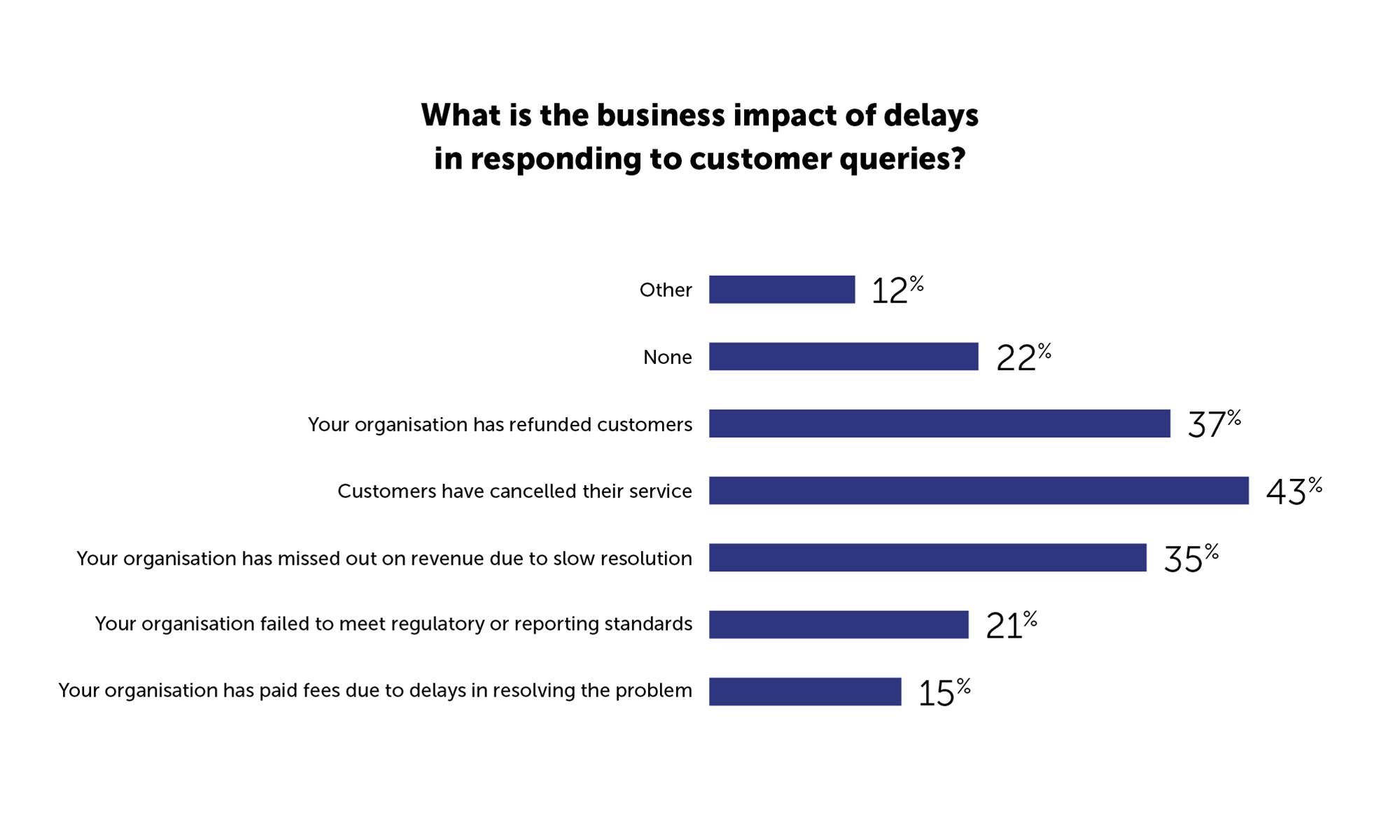

That is why it is more common to see the heads of the LOB now being aligned with customers’ digital experiences. According to Zarabi, the wider business risk of poor complaint and disputes handling is clear: whether it’s loss of business, reputational damage, or the risk of regulatory non-compliance, it can have significant financial and social impacts.

“What is critical, is that it is not just losing that particular customer, it’s losing all the future prospective customers,” Zarabi said.

Ultimately, the panellists agreed that there is now significant traction at the board level concerning complaints and disputes handling, and that it is finally being addressed.To view iTnews and ServiceNow’s recent webinar, watch the recorded livestream here.